What to look for in POS apps: simplicity

Gabi James - 6th Jun, 2023

Looking for a simple, slick Point of Sale system that allows you to hit the ground running? Here's everything you need to know...

Continuing our series on what makes the best POS system, we’re focusing on the importance of an elegantly simple solution.

To recap what POS systems are all about, have a look at our introductory post. And don’t miss yesterday’s article all about multi-channel solutions!

Plus, over the next few days we’ll dive into the other key things to look for in your POS technology:

- Cost

- Instant payment

- Security

- ESG

- Minimised hardware

- Integration with your existing payment methods and administrative systems

The importance of a simple POS system

In any company in any industry, time is precious. More precious still is your staff’s satisfaction.

So when you’re choosing a POS system, be mindful of how easy it’s going to be for your staff to learn to navigate the system in the first place, and to use it as frequently as they make sales.

Beware the bells and whistles

Some POS apps seem to offer an alluring array of features and functions, endless insights and ostensibly optimised flows. But if it’s going to take days or even weeks to train staff to use them, you’re losing valuable time and crucial sales.

Even worse, these features can quickly become obstacles to what should be a speedy and simple payment process. And what one POS system provider thinks is an optimised payment flow might actually be counterintuitive and counterproductive for your staff and customers. Not everyone orders their drink in the same way, for example. Do staff really need to click through several screens of milk choices, syrups and extra toppings when a customer asks for a black coffee?

We’d suggest looking for a slick, simple POS app that knows what it does and does it well. Systems that try to do too much often become convoluted and unwieldy, and end up eating into staff time – not just hours of training, but in every single transaction. That translates to frustrated staff and customers, and a slump in sales as staff can attend to fewer customers in a given period.

The simplest solution is barely detectable

Open Banking transactions deliver on this front, particularly with providers like Wonderful that make payments simple and easy. In fact, staff that use Wonderful have almost nothing they need to do; simply display the QR code and customers can scan it using their smartphone. Staff needn’t learn to use any hardware or software at all!

And for the people on your team who need to see the numbers or handle administration, our One app is free and incredibly easy to use. You can manage and add admins, and see all of the sales data at a glance, including:

- Total revenue

- Number of customers

- Number of orders

- Number of payments

You can also see breakdowns of each to find whatever details you need!

Plus, creating new orders is really straightforward, giving you and your staff individual links and QR codes as needed so that customers are presented with prepopulated payments – the amount and recipient filled in for every transaction. All they need to do is approve the payment in their banking app.

A simple user experience

That brings us to the customer’s experience of paying you.

Modern businesses know the value of a smooth checkout process. And while card payments may be familiar to customers, they were introduced fifty years ago to meet the demands and expectations of an almost unrecognisable market.

Today, customers are laser-focused on speed, convenience and security. They want to check out in a matter of seconds and a few clicks, without putting their data or money at risk.

When faced with forms, drop-down menus, or even a keypad to enter a four-digit PIN, many customers have their patience tested.

That’s why many companies are realising it’s time to harness the power of Open Banking: Open Banking transactions, like the ones Wonderful facilitates, provide speed and ease, all while heightening security.

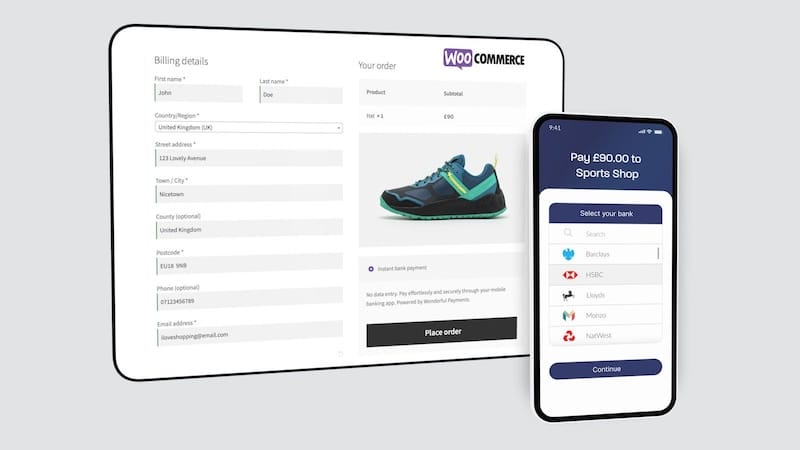

We make it simple. By scanning a QR code or clicking a link, your customers select their bank and are taken straight to their banking app, where they find the pre-populated payment to approve – typically with an instant face or fingerprint scan. And that’s it!

If you want to just how fast and easy this instant payment method is compared to traditional card payments, take a look at this video:

This seamless and secure payment flow is a surefire way to boost customer satisfaction and retention, and keep them coming back for more.

Embrace the future of Point of Sale systems

To future-proof your business, provide Open Banking instant payments at the point of sale.

Not only will you get the newest, safest and simplest payments technology, but you’ll enjoy a whole host of benefits like:

- Increased satisfaction for staff and customers

- A streamlined checkout process

- Boosts in sales

- Reduced costs

- Instant payments

- Heightened security

- Inherent CSR

Plus, our friendly team is on-hand to support you through the simple onboarding and integration process, so that you can have instant bank payments sitting alongside your existing methods in no time. Get started with a FREE TRIAL today!

Introducing One: Instant bank payments, in your pocket

One is a simple and intuitive mobile app that allows businesses to slash transaction fees, bill for any product or service, and request instant payments via QR codes or secure links. 1,000 transactions for just £9.99 per month (that's just 1p per transaction).