What to look for in POS apps: multi-channel solutions

Gabi James - 5th Jun, 2023

The first in our 8-part series on the best POS system looks at the importance of a multi-channel solution.

To kick off our series on finding the best Point of Sale system for your business, we’re thinking about why it’s so important to find a solution that works across multiple channels.

Keep checking back each day as we cover the other key areas you’ll want to think about:

- Simplicity

- Cost

- Instant payment

- Security

- ESG

- Minimised hardware

- Integration with your existing payment methods and administrative systems

And if you want a refresher on what POS systems are all about and why they’re so important, read over our introductory post.

Multi-channel Point of Sale solutions

Modern consumers don’t all approach shopping in the same way, so modern businesses can’t provide just one way to buy.

That’s why it’s best to look for a POS app that makes it easy to sell in person, online, over the phone and even out in the field. That way, you’re ready for anything.

Maybe you’re a personal trainer who happens to strike up a conversation with a keen prospective customer in the park. Or perhaps you’re running a pop-up to peddle your wares in a street market, or selling sample-size cosmetics at a convention. You could have a powerful outbound sales team converting prospects on the phone, as well as a steady stream of inbound customers finding their way to your online store, and heavy foot traffic in your brick-and-mortar locale.

Whatever the case, you should be ready to take payment straight away, in a manner that’s easy, reliable and – above all – secure for your customers.

Why card payments won’t cut it

Of course, some of these scenarios rule out POS methods that rely on physical interaction – including cash, chip and PIN and contactless payments.

For many customers, making card payments over the phone is also out of the question, both because of the inconvenience of reading out long card numbers and expiry dates, and because of the security concerns that brings up.

Preparing for all eventualities

So is there any one system suitable for all these scenarios – and all the others that could bring you customers?

As with most of the factors we’re thinking about in our POS series, having an adaptable and integrative approach is key. Ideally, you’ll want a POS system that incorporates several payment methods, so that each prospective customer can use the one they prefer at a given moment.

Instant bank payments

One solution that works well across the board is the Open Banking instant bank payment solution we mentioned in yesterday’s article.

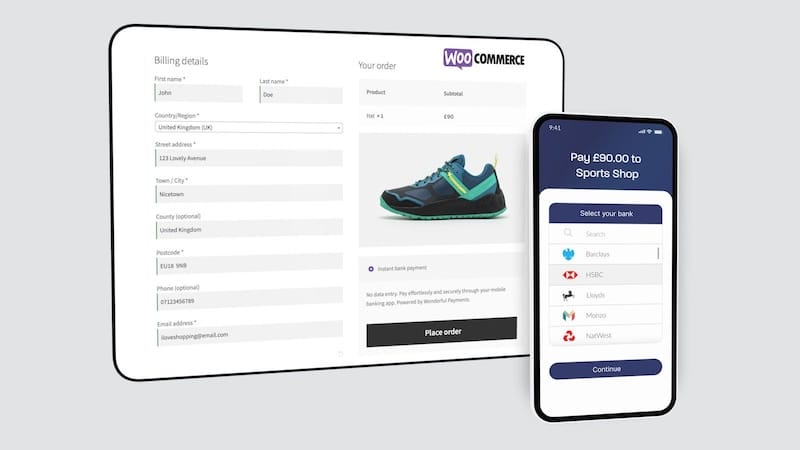

For transactions on the ground – be it in the park, at a pop-up, or in a convention – you can provide customers with a QR code (printed out on leaflets, posters, clipboards, drinks mats, or even just by showing it on a smartphone) that takes them straight to the pre-filled transaction on their banking app.

Sales teams can use email or chat functions to send a single URL (or indeed QR code!) which will do the same things for customers they’re speaking to on the phone or live chat. And inbound online consumers will have the same option.

For all of these scenarios, customers are taken straight to their own banking app, where they’ll see and approve the payment. The familiarity and confidence of using their online banking assures them the transaction is secure, and they’ll be happy to buy from you again.

Once they approve the payment – typically using face or fingerprint ID, or whatever authentication they prefer, the funds are settled instantly. You can move onto providing them with your brilliant product or service, and attending to the next customer right away.

And Open Banking even allows for Variable Recurring Payments (VRPs), offering a better, safer and more convenient alternative to Direct Debits and similar set-ups. So if you are a personal trainer, tutor, or use any other kind of subscription-based model, this is yet another benefit!

Embrace the future of Point of Sale systems

To future-proof your business, provide Open Banking instant payments at the point of sale.

Not only will you get the newest and safest payments technology – one that works across channels and contexts – but you’ll enjoy a whole host of benefits like:

- Increased satisfaction for staff and customers

- A streamlined checkout process

- Boosts in sales

- Reduced costs

- Instant payments

- Heightened security

- Inherent CSR

Plus, our friendly team is on-hand to support you through the simple onboarding and integration process, so that you can have A2A payments sitting alongside your existing methods in no time. Get started today!

Introducing One: Instant bank payments, in your pocket

One is a simple and intuitive mobile app that allows businesses to slash transaction fees, bill for any product or service, and request instant payments via QR codes or secure links. 1,000 transactions for just £9.99 per month (that's just 1p per transaction).