What to look for in POS apps: cost

Gabi James - 7th Jun, 2023

Here we explore how you can find the most cost-effective Point of Sale system and save a bundle on processing fees.

Welcome back to our series dedicated to helping you find the right POS system for your business! For an overview of what the series is all about, have a look at our introductory POS blog post. And make sure you catch up on our deep-dive into multi-channel solutions, and the importance of simplicity.

In yesterday’s POS systems article, we thought about the importance of providing an easy and quick payment method at the point of sale. Because we all know time is money.

But so is – well, money. And while you don’t need to scrimp on something as pivotal as your Point of Sale system, you also don’t want to spend unnecessarily.

So today’s blog post is all about finding the most cost-effective POS system without cutting corners, sacrificing functionality, or putting sensitive information at risk.

Why are Point of Sale systems so expensive?

Unfortunately, the POS systems that dominate are unnecessarily expensive. Card transactions and digital wallets bring significant processing fees that mean a percentage of every sale is taken by a third party.

On top of that, you’re likely paying a per-transaction fee, and very often a subscription to your POS system provider. Plus, you have to shell out for the hardware needed to process these transactions!

How much do card-based POS systems cost?

Let’s take a look at some of the most popular Point of Sale systems to illustrate the associated processing fees.

Square POS

Square offers a popular and robust POS system. The processing rate for transactions varies according to the payment method:

- 1.75% of each Chip and PIN or contactless payment for every major debit and credit card, Apple Pay and Google Pay

- This raises to 2.5% for Virtual Terminal and Invoices

- Online transactions have not just a percentage deducted, but a flat fee on top of that: 1.4% + 25p for online transactions with UK cards, and 2.5% + 25p for online transactions with non-UK cards

Stripe

Another widely used provider is Stripe. Their fees are:

- 1.5% + 20p for standard UK cards

- 1.9% + 20p for premium UK cards (including all business and corporate cards)

- 2.5% + 20p for EU cards

- 3.25% + 20p for international cards outside of the EU

If currency conversion is required, there’s an additional 2% fee on top of the above.

Shopify

With Shopify, you’ll have a monthly subscription fee of at least £25, plus these per transaction fees:

- 2% + £0.25 online

- 1.7% in person

Mammoth savings

All of these fees and percentage deductions can add up fast. Especially if you have high-volume transactions, or are selling frequently and using a POS system that adds a flat fee on top of its percentage deduction.

But thankfully, there is another way.

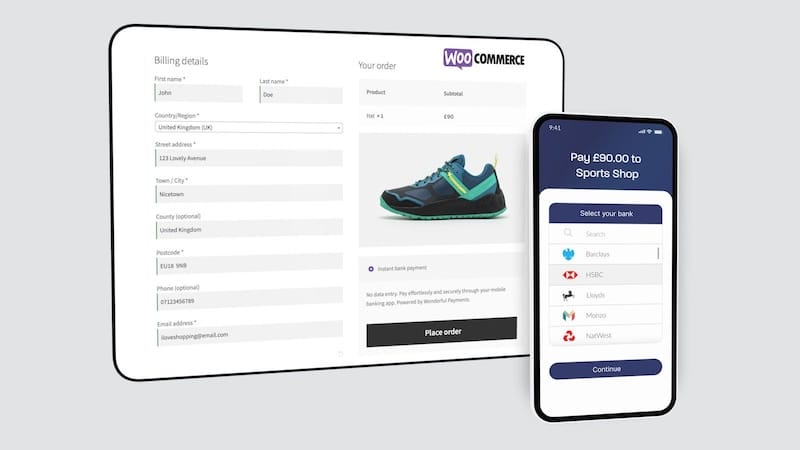

If you add instant Open Banking transactions to your current payment methods, you can save a bundle.

Look at Wonderful’s pricing model: we don't calculate our fee based on the value of each transaction.

In fact, with our intuitive One app, you pay £9.99 per month for 1,000 transactions - (that's just 1p per transaction).

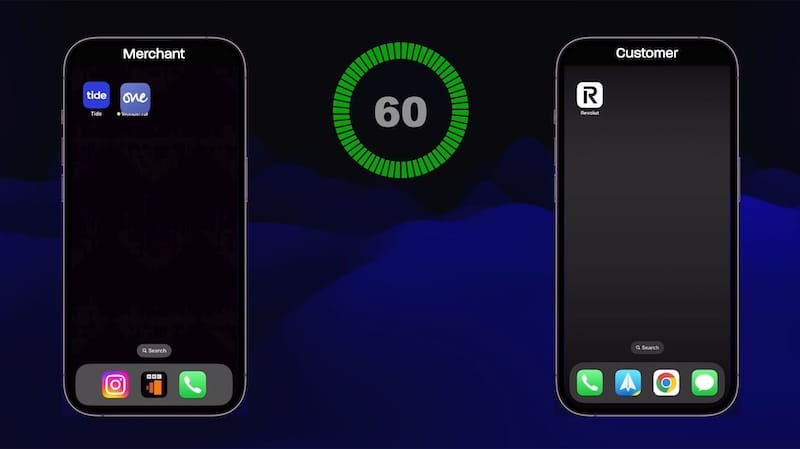

Introducing One: Instant bank payments, in your pocket

One is a simple and intuitive mobile app that allows businesses to slash transaction fees, bill for any product or service, and request instant payments via QR codes or secure links. 1,000 transactions, for just £9.99 per month (1p per transaction).

That’s right: for just £9.99 each month, you can take 1,000 payments! Compared with the ever-growing mountain of per-transaction fees and deductions, that means enormous savings for almost every business or service provider, whether you’re selling hand-knitted scarves, teaching ESL one-on-one, or selling thousands of pastries each day.

How can we offer such a generous model? Because we don’t need to factor in the huge expense of processing card payments. We cut out the middle man, so customers move money directly from their bank account to yours. And remember, you get a free 14 day trial with no strings attached to see why Open Banking is at the forefront of POS technology!

Embrace the future of Point of Sale systems

To future-proof your business, provide Open Banking instant bank payments at the point of sale.

Not only will you get the newest, safest and most cost-effective payments technology, but you’ll enjoy a whole host of benefits like:

- Increased satisfaction for staff and customers

- A streamlined checkout process

- Boosting sales

- Instant payments

- Heightened security

- Inherent CSR

Plus, our friendly team is on-hand to support you through the simple onboarding and integration process, so that you can have instant bank payments sitting alongside your existing methods in no time. Get started today!

And come back tomorrow to learn more about POS systems and how you can move from weekly or monthly deposits to instant payments.