Choosing the best Point of Sale payment system for your business

Gabi James - 1st Jun, 2023

Looking for a modern, convenient and cost-effective Point of Sale system? This mini-series will help you find the best solution for your business.

Point of Sale technology has been flourishing over recent years. Today, businesses have not just better options, but a much wider range of solutions – allowing for that all-important tailored touch that lets you optimise your process for your business, employees and customers, and stand out from your competition.

And with that competition growing rapidly while margins shrink and customers are forced to think carefully about how and where they spend money, finding the perfect Point of Sale solution for your company has never been more important. In fact, Vend conducted a study which revealed that an advanced POS system translates to a 20% increase in sales, a 25% jump in customer retention, and a 15% rise in customer satisfaction.

In short, your POS system is a quick, simple and inexpensive tool to boost your business across the board. Choose right and it might even save you money, too!

To help you find the best Point of Sale payment system for your business, over the coming days we’re going to look at the key factors and features to have in mind as you compare the ever-evolving roster of solutions.

What is a Point of Sale system?

Before we dive into how you can choose the best POS solution, let’s review what the term means.

First, what is Point of Sale, or POS?

Pretty much what the name suggests: the place (physical or digital) where a purchase happens.

At the POS, we can expect to see:

- A customer

- A merchant

- A product/service

- An exchange of money

- A POS system enabling this exchange

Any monetary exchange processed through a POS system is referred to as a POS transaction.

A POS system doesn’t need to include cutting-edge technology; a cash register could qualify. But in 2023, most companies need a more sophisticated approach.

Modernising the POS experience

Over the past few decades, the simple cash register was almost universally usurped by electronic POS terminals that process credit cards and debit cards as well as cash. So nowadays, what might be called ePOS systems have become ubiquitous. These systems comprise a network of computers headed by a main computer – there are usually multiple terminals facilitating transactions, and these terminals can have lots of features depending on the needs of the business.

Most modern ePOS systems include a computer, a cash drawer, a card payment terminal, a receipt printer, a customer display, and a barcode scanner. Often, retailers provide tablets or smartphones that staff and customers can use to navigate the purchase process.

Of course, two decades into the twenty-first century, even chip and PIN transactions are outmoded. Customers in the UK expect to see MPOS or Mobile Point of Sale solutions – the ability to process transactions via mobile wallets, typically without any contact or need to enter a PIN thanks to a wireless standard NFC (Near Field Communication).

The future of POS apps

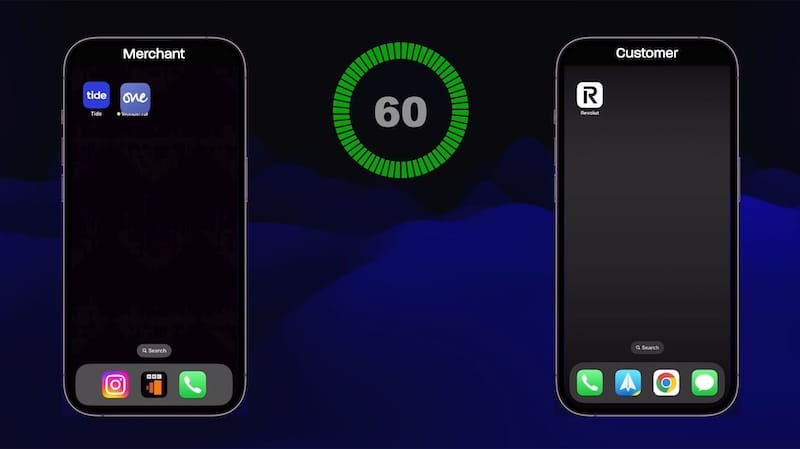

With the emergence of Open Banking allowing direct and instantaneous account-to-account payments, even contactless card payments will soon seem clunky and inconvenient.

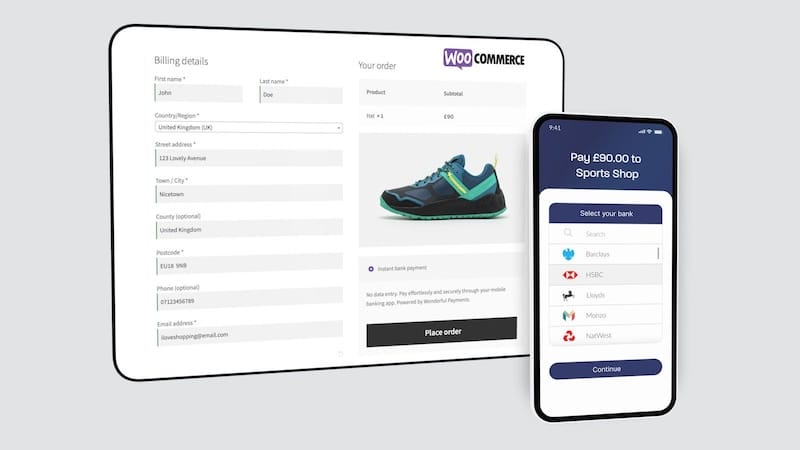

FCA-regulated Open Banking payment providers like Wonderful make the POS experience seamless for both customers and businesses. There’s no longer the need for businesses to shell out for any hardware – not a cash register, not a card reading terminal, not a tablet in sight.

Instead, customers scan a QR code and are taken straight to their banking app to complete a secure transaction – with the amount and recipient (read: your business) auto-filled. Using their face ID, fingerprint or whatever authentication they prefer, they can immediately approve the transaction, at which point the funds move straight from their bank account to yours.

Not only is this a quicker experience for them, it also means your business receives funds immediately rather than days later, and saves you a huge amount on card processing fees – on average, companies can expect savings of at least 90% by choosing Wonderful. More on that over the coming days!

But now, let’s look at the features and functions to have front-of-mind as you search for the best POS system.

8 Point of Sale system features to look for

While every company and every business model brings its own needs, and each demographic can have different expectations when it comes to POS experiences, there are some important considerations that every merchant or service provider should take into account.

Whether you’re running a multi-store retail conglomerate or you’re a private tutor or personal trainer, remember that with the right approach to POS you can increase sales, retention and satisfaction, and save yourself money.

So what is the right approach? We’d suggest you focus on these eight areas:

- Multi-channel solutions

- Simplicity

- Cost

- Instant payment

- Security

- ESG

- Minimised hardware

- Integration with your existing payment methods and administrative systems

For now, here’s a quick overview of what we’ll be thinking about for each of these areas.

1. Multi-channel solutions

Modern consumers don’t all approach shopping in the same way, so modern businesses can’t provide just one way to buy.

That’s why it’s best to look for a POS that makes it easy to sell in person, online, over the phone and even out in the field.

In our next blog post, we’re going to help you find Point of Sale solutions that are well suited to all of the scenarios where your business could encounter customers – and think about whether there’s really one POS app that could fit the bill across the board.

Read more: What to look for in POS apps: multi-channel solutions

2. Simplicity

A Point of Sale system that requires hours and hours of staff training and makes purchasing your product or service an arduous process is not an efficient one.

While choosing the system with the most features and the ‘optimised’ flows might be tempting, more often than not all of these (very expensive) bells and whistles end up getting in the way.

Likewise, you want to ensure your customers have smooth, painless checkout experiences – or they may be reluctant to repeat them. Keep in mind that a massive 44% of consumers say they will never return to an online retailer if they have a poor checkout experience!

So we’re going to think about what you really need in a POS system, and how you can find the simplest and most elegant solution.

3. Cost

The Point of Sale is pivotal for your business in all kinds of ways, and it certainly isn’t an area where you want to scrimp or cut corners.

That being said, the POS systems that dominate are inordinately expensive. What if we told you that you could save a huge amount, all while improving the other seven areas we’re covering?

Make sure you check out our third pointer to find out how!

4. Instant payment

One of the drawbacks the vast majority of POS systems share is the long delays in granting businesses access to their money. Typically, you can expect to wait several business days or a week to receive funds, and some even do monthly deposits.

But getting your money right away could give you more budget to play with, allowing you to invest in other areas and keep growing your business. It also helps keep your books balanced and can keep your business from teetering into the red.

So if you want to find out how you can get instant settlements without paying a premium to access your own money, read the fourth instalment of our series.

5. Security

At the Point of Sale, you’re handling your customers’ and your business’s money, and often sensitive financial data. It’s not an area where you can take any security risks.

Unfortunately, many businesses fail on this front. In 2021 alone, the financial data of more than 40 million people in the UK was compromised. Mistakes like that cost: not just in large fines, but in the customers you’ll inevitably lose and the irreversible PR damage.

So we’re taking a look at how you can best minimise risk and protect your customers and your company in our in-depth article.

6. ESG

While few businesses can question the importance of a strong ESG stance, it might not be something you immediately associate with your Point of Sale system.

But perhaps it should be. This, after all, is one of the defining moments in your relationship with your customer. And how they feel about giving you their hard-earned money will play a big part in determining whether they turn into a loyal customer or never come back at all.

So if you can use this moment to show your company’s best side, why wouldn’t you?

Find out how you can do just that in our sixth article!

7. Minimised hardware

Modernising means simplifying, streamlining, shrinking. Compare the weighty, wired telephones of the nineteenth century with the palm-sized devices we slip into our pockets each day – packed with a camera, phone book, Atlas, Rolodex, record collection and the entire contents of the Internet to boot.

POS systems should be no different. Agility and flexibility are keys to success, and clunky POS tools are fast becoming deadweight. Plus, hardware is prone to fail, and brings extra expenses in buying or renting it, maintaining it, and replacing it when it gets damaged or stolen.

Find out how you can get a robust and reliable POS system without being encumbered with a load of card terminals, cash registers and costly tablets.

8. Integration with your existing payment methods and administrative systems

While updating your POS system could revolutionise your business in invaluable ways, there’s no need to try to fix lots of other things that ain’t broke – particularly as you might inadvertently break them in the process.

Lots of POS solutions encourage (or require) you to adopt them wholesale across the board, using them for everything from inventory to customer management.

But if you already have systems in place, transferring your data and processes will be at best time-consuming, and at worst result in lost information, disrupted service, and huge costs.

Instead, we’ll help you find POS solutions that fit seamlessly with the processes you’ve already fine-tuned, and the tools you and your team are familiar with.

Become a POS expert

And there’s a quick round-up of some of the big topics we’ll be covering. If you want to learn more about how your POS choices can boost your business, make sure you read our eight dedicated articles.

Over the coming days, we’ll look at each of these areas in more detail. Stay tuned!

Start your free trial with Wonderful today.